2025 Irs Tax Brackets Married Filing Jointly Or. The irs increased its tax brackets by about 5.4% for each type of tax filer for 2025, such as those filing separately or as married couples. The standard deduction for single.

For this study, gobankingrates found the take home amount from a $200,000 salary in every. Here’s a look at the new tax brackets that will be used when filing in 2025.

The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year.

2025 Tax Brackets Married Filing Jointly Irs Dyana Cristal, Us tax brackets 2025 married filing. For this study, gobankingrates found the take home amount from a $200,000 salary in every.

2025 Tax Brackets Married Jointly Kelli Melissa, How do california tax brackets work? The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2025 tax year.

2025 Irs Tax Brackets Married Filing Jointly Celine Lavinie, The standard deduction will also increase in 2025, rising to $29,200 for married couples filing jointly, up from $27,700 in 2025. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing.

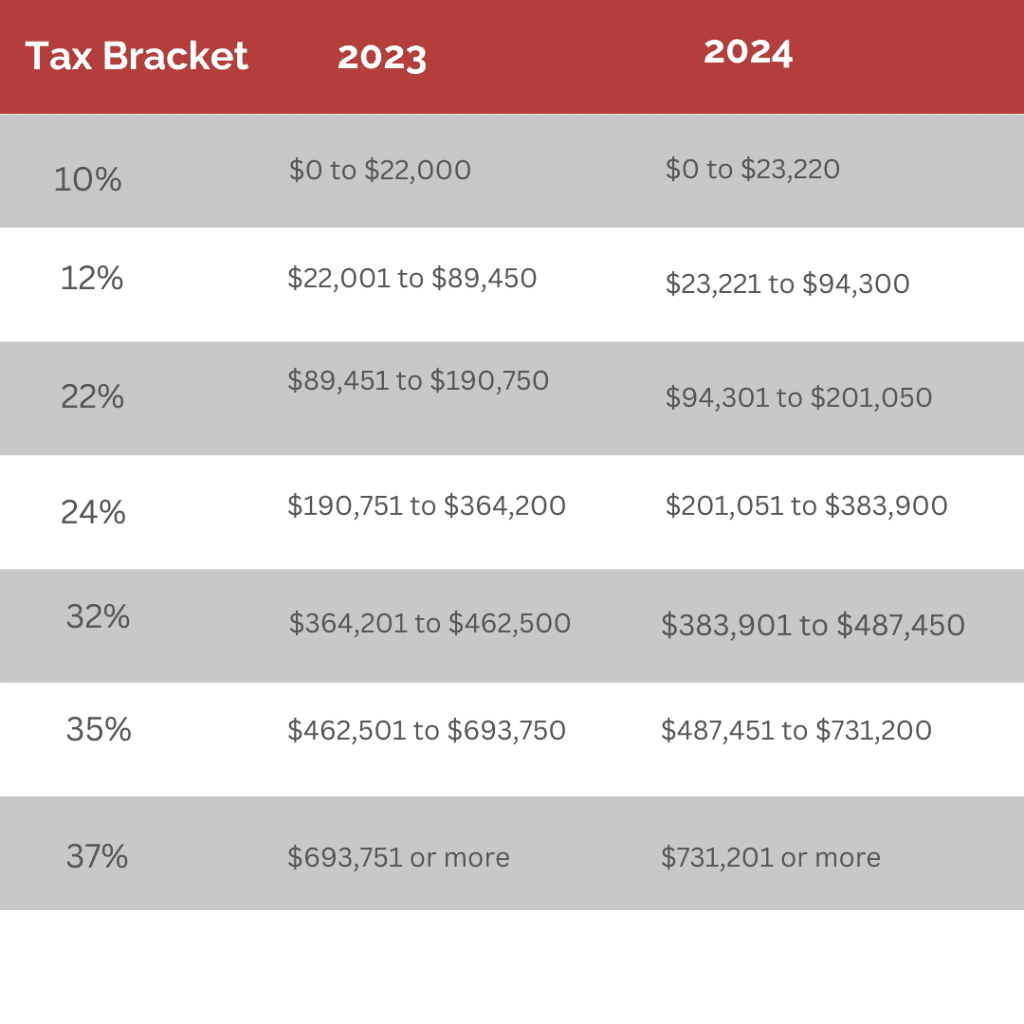

Tax Brackets 2025 Single Vs Married Row Hedvige, The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%. Page last reviewed or updated:

IRS Sets 2025 Tax Brackets with Inflation Adjustments, For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it. Married filing jointly tax brackets 2025.

2025 Tax Brackets Married Jointly Kelli Melissa, Updated tue, apr 9 2025. Irs announces 2025 tax brackets, updated standard deduction.

Tax Bracket Changes 2025 For Single, Household, Married Filling, There are seven tax brackets for most ordinary income for the 2025 tax year: Projected 2025 tax rate bracket income ranges.

2025 Tax Brackets Married Filing Separately Excited Aubry Albertine, There are seven federal tax brackets for tax year 2025. Us tax brackets 2025 married filing.

2025 Tax Brackets Mfj Limits Brook Collete, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any additional. Married filing jointly or qualifying surviving spouse.

Mfj Tax Brackets 2025 Irs Edita Gwenora, The standard deduction is the fixed amount the irs. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples.

The standard deduction will also increase in 2025, rising to $29,200 for married couples filing jointly, up from $27,700 in 2025.